2024 Advisory Services Survey

See how advisors are keeping up with client requests for financial services – and where there are gaps to fill.

Tour the TPCP® Program

Related Posts

Exit Planning for Business Owner Clients

View DetailsWelcome Alfonso Cobb

View DetailsSeptember 24, 2024

The American College of Financial Services surveyed advisors about the services they offer relative to what their clients request. The results reveal big opportunities – especially regarding tax-informed planning strategies and the new TPCP® program.

The new 2024 Advisory Services Survey explores key similarities and differences in service offerings and client needs among three types of financial professionals: dually registered advisors (Duals), investment advisor representatives (IARs), and those who are either insurance agents (IAs) or registered representatives (RRs). The results reveal opportunities for independent advisors to differentiate their practices, as well as areas in which captive advisors have clear advantages.

What Services Do Advisors Offer?

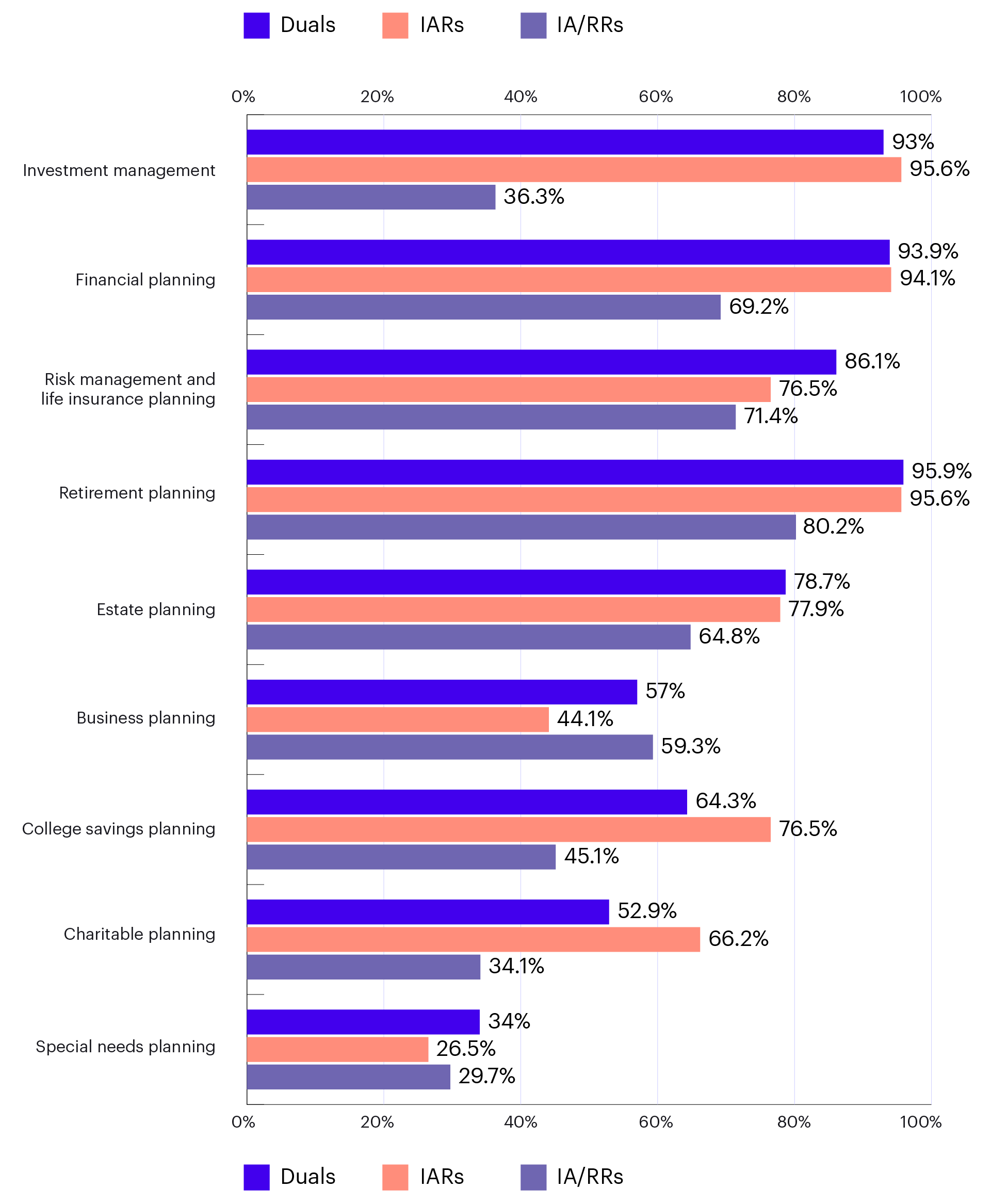

The survey began by asking advisors about the services they are currently offering to clients. Across all three advisor types, the data shows independent advisors, both dually registered and IARs, are leading the way in delivering a wide gamut of services to their clients, including: charitable planning, college savings planning, estate planning, retirement planning, risk management, financial planning, and investment management.

“Independent advisors, both dually registered and IARs, are leading the way in delivering a wide gamut of services to their clients.”

However, IARs are less likely to offer special needs planning and both IARs and Duals fall short in offering business planning services – with only 57% of dually registered advisors and a mere 44% of IARs offering such services.

Services Currently Offered

By Advisor Type:

The American College of Financial Services. Advisory Services Survey. 2024.

What Strategies Do Advisors Use?

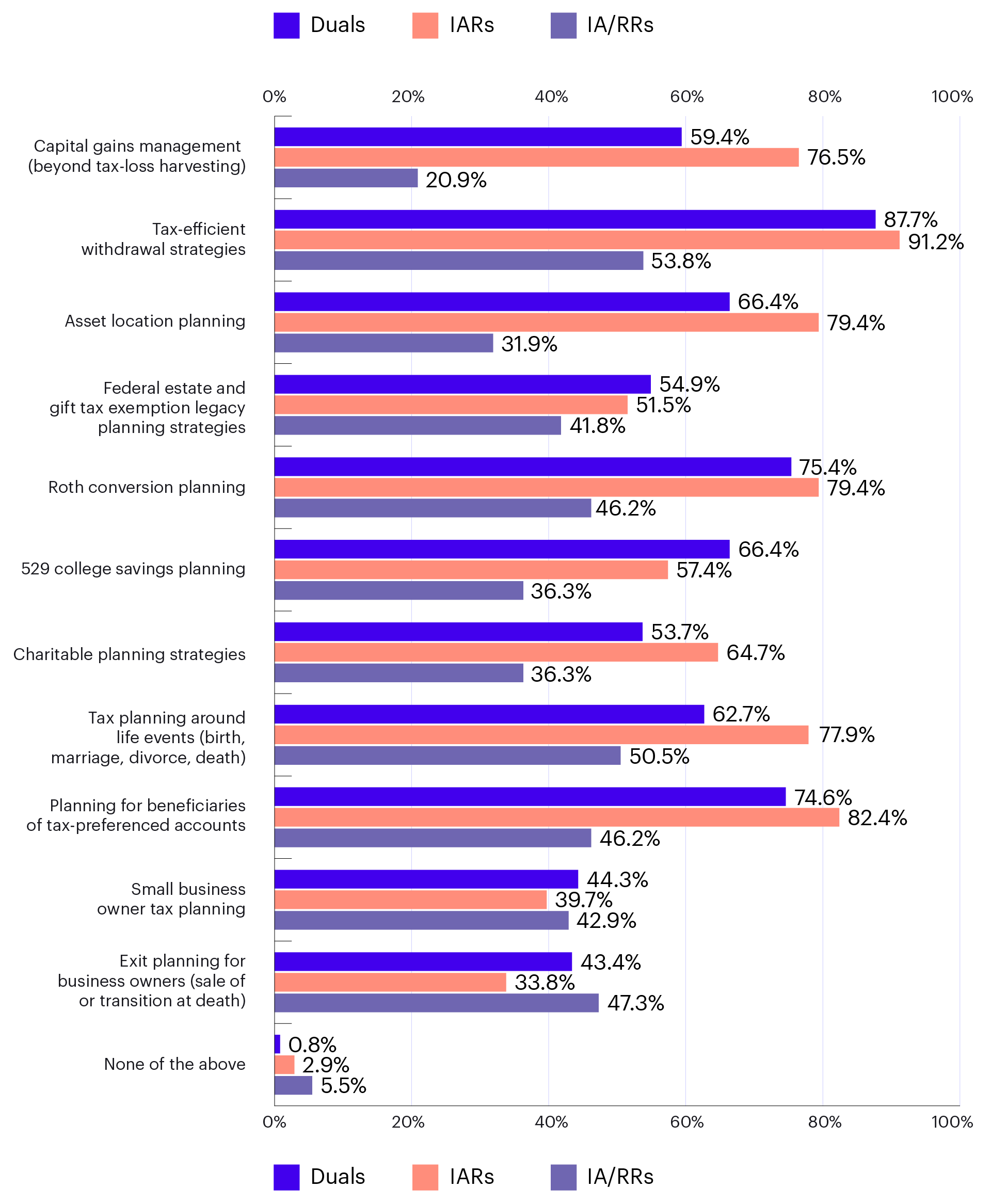

The data further suggests that independent advisors are leading the way in using various strategies – especially tax-informed planning strategies – to deliver the many services they offer clients. Financial professionals who are dually registered or IARs have a competitive advantage in delivering tax-informed planning strategies to differentiate their practices.

In contrast, insurance agents and registered representatives are often required to comply with the restrictions of their home office in regard to tax planning services. However, our research suggests that over half of these insurance agent and registered representative respondents employ tax-efficient withdrawal strategies (54%) and conduct tax planning around life events with their clients (51%).

Strategies Currently Used

By Advisor Type:

The American College of Financial Services. Advisory Services Survey. 2024.

Unfortunately, with many home offices not offering a comprehensive education on tax planning services, it would seem that the respondents currently utilizing these tax-efficient withdrawal strategies and conducting tax planning related to life events could benefit from some form of formal education to improve their effectiveness and raise overall client satisfaction.

“[Advisors] currently utilizing these tax-efficient withdrawal strategies and conducting tax planning related to life events could benefit from some form of formal education to improve their effectiveness and raise overall client satisfaction.”

What Services Are Not Being Offered?

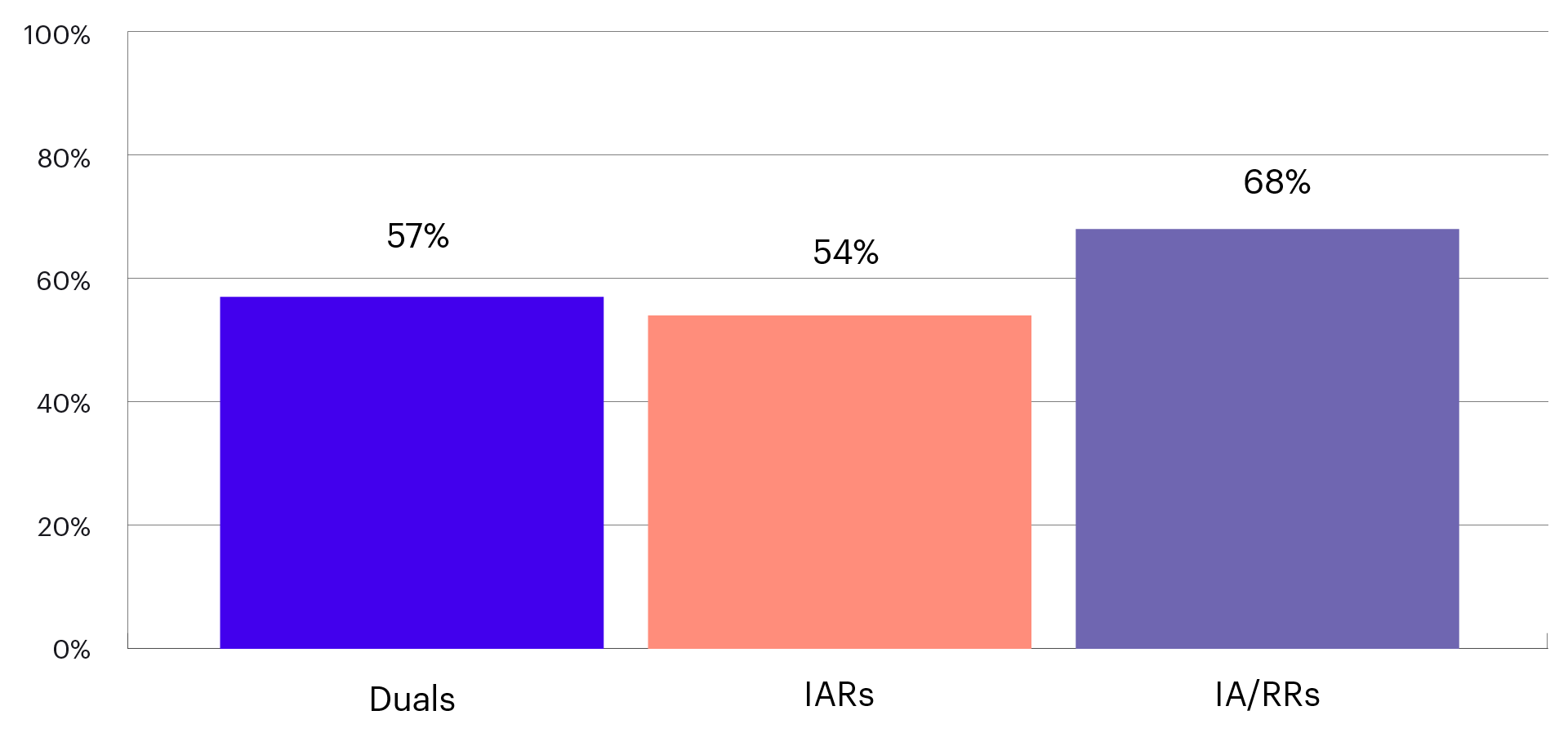

Finally, the survey asked advisors about the services their clients frequently request – to reveal any gaps in their current offerings. When reviewing this data, one significant outlier emerges. More than 68% of insurance agents and registered representatives, 54% of IARs, and 57% of dually registered advisors reported small business owner tax planning as the most frequently requested service among those they are not currently providing.

This represents a sizable unmet need that could prove to be a differentiator for any advisors willing to add these services to their menu. Yet, without comprehensive education on tax planning services or robust tax planning resources, how can we ensure that financial professionals across the financial services ecosystem do tax planning well?

Strategies Not Used But “Always” or “Often” Requested

Small Business Owner Tax Planning:

The American College of Financial Services. Advisory Services Survey. 2024.

Financial Planning Is Tax Planning

When reviewing the results of this survey in totality, an interesting trend emerges. Many advisors partake in some form of tax-informed financial planning. Independent advisors are more likely to say they engage in tax planning than others – but more than half of all types of advisors are currently employing tax-advantaged strategies. However, across all categories, advisors are not meeting the needs of their clients when it comes to small business tax planning, a valuable service that many advisors could benefit from offering to their clients.

Fortunately, financial advisors can address this gap through a new designation at The College. The Tax Planning Certified Professional® (TPCP®) program is The College’s latest offering to the financial services industry and addresses this need. As advisors look to implement advanced tax strategies in their own practices, the TPCP® program can help them by equipping participants with the skills to identify and evaluate these strategies for individuals and small businesses with a focus on maximizing tax benefits while ensuring compliance with current legislation.

The program covers a number of different topics including tax planning during the accumulation phase and the less frequently covered topic of tax planning during retirement (or the decumulation phase).

Enrollment for this powerful new designation launches in November and, with advisors already lining up to be among the first to call themselves a Tax Planning Certified Professional™, the time is perfect to seize this opportunity and join them as you look to grow your practice by improving your ability to meet the needs of your clients.

Learn about our Tax Planning Certified Professional® TPCP® program

Related Posts

Exit Planning for Business Owner Clients

View DetailsWelcome Alfonso Cobb

View Details