Planning for a Longer (and More Expensive) Retirement

Insights from retirement expert Michael Finke, PhD, CFP® on helping clients understand and engage with longevity planning

Author

PhD, CFP®

Subscribe to Newsletter

Related Posts

Reflecting on 25 Years of the Forum on Ethical Leadership

View DetailsPlanning for a Longer (and More Expensive) Retirement

May 20, 2024

The Retirement Income Literacy Study from The American College of Financial Services shows older Americans underestimate longevity. This can lead to undersaving, claiming Social Security at a younger (than necessary) age, and a failure to plan for old age spending.

How long is retirement going to last?

Underestimating life expectancy is a problem for all older Americans, but especially for higher-income Americans, who have made significant gains in longevity after the age of 65. A longer retirement is a more expensive retirement, and financial planners need to understand how long their clients are likely to live and develop strategies for funding longer lifestyles.

Most people have a vague idea of how long they are likely to live in retirement. It’s common to think of the age our parents or grandparents died when estimating our own longevity. In reality, longevity after the age of 65 increased by about a year every decade in the 20th century, and higher-income Americans can expect to spend significantly more years in retirement.

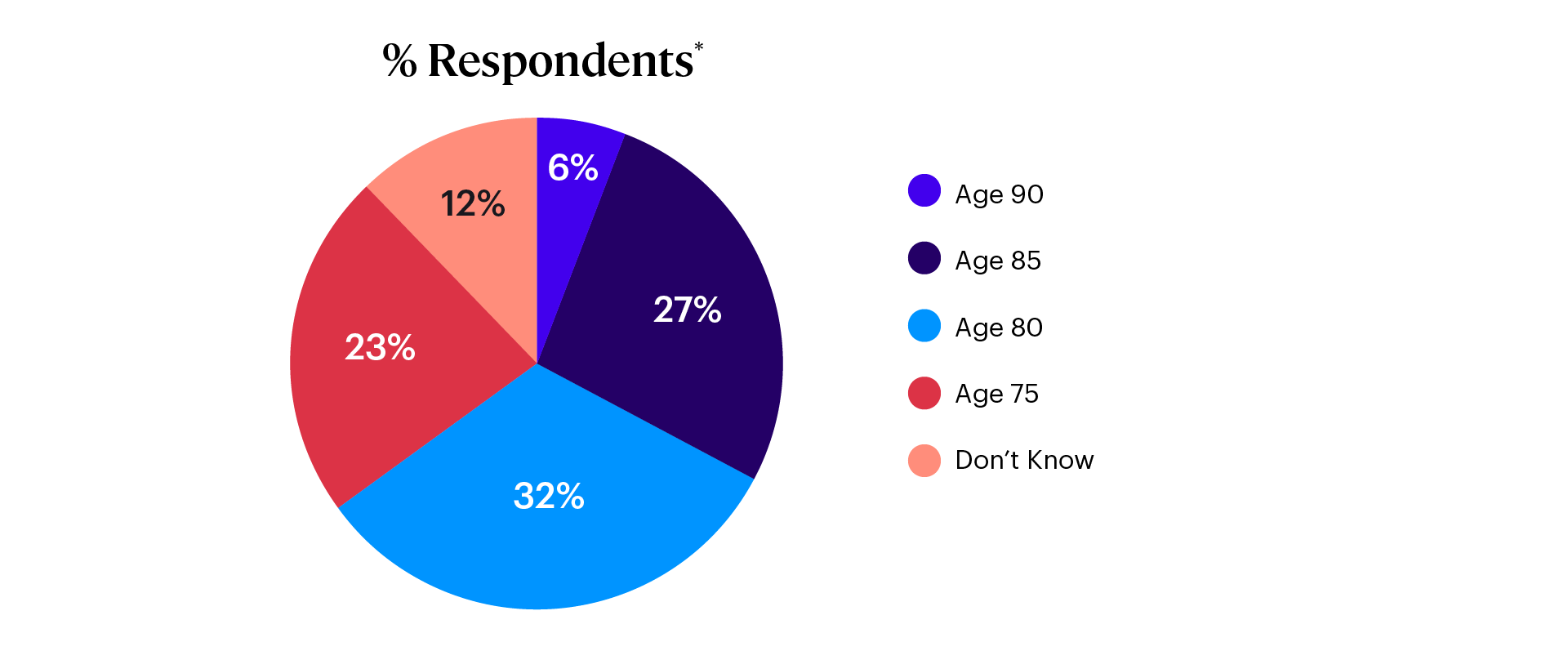

According to the Social Security Administration mortality tables, half of American men who have reached age 65 will live to at least age 85 and half of women will live to at least age 88. Respondents to the 2023 Retirement Income Literacy Study were asked how long an average 65-year-old man could expect to live. Only 27% selected the correct answer (20 years), 32% thought the average man would live to age 80 (15 more years), 23% believed only 10 more years, just 6% thought an average man would live to age 90, and 12% indicated that they didn’t know.

Respondents’ Expected Longevity of a 65-Year-Old Man

Figure 1

Most Respondents* underestimate or don't know the expected longevity of a 65-year-old man, which is about 20 years (age 85).

In other words, 55% of respondents underestimated retirement longevity and an additional 12% didn’t know. Just a third of respondents (33%) had an accurate or optimistic idea of retirement longevity.

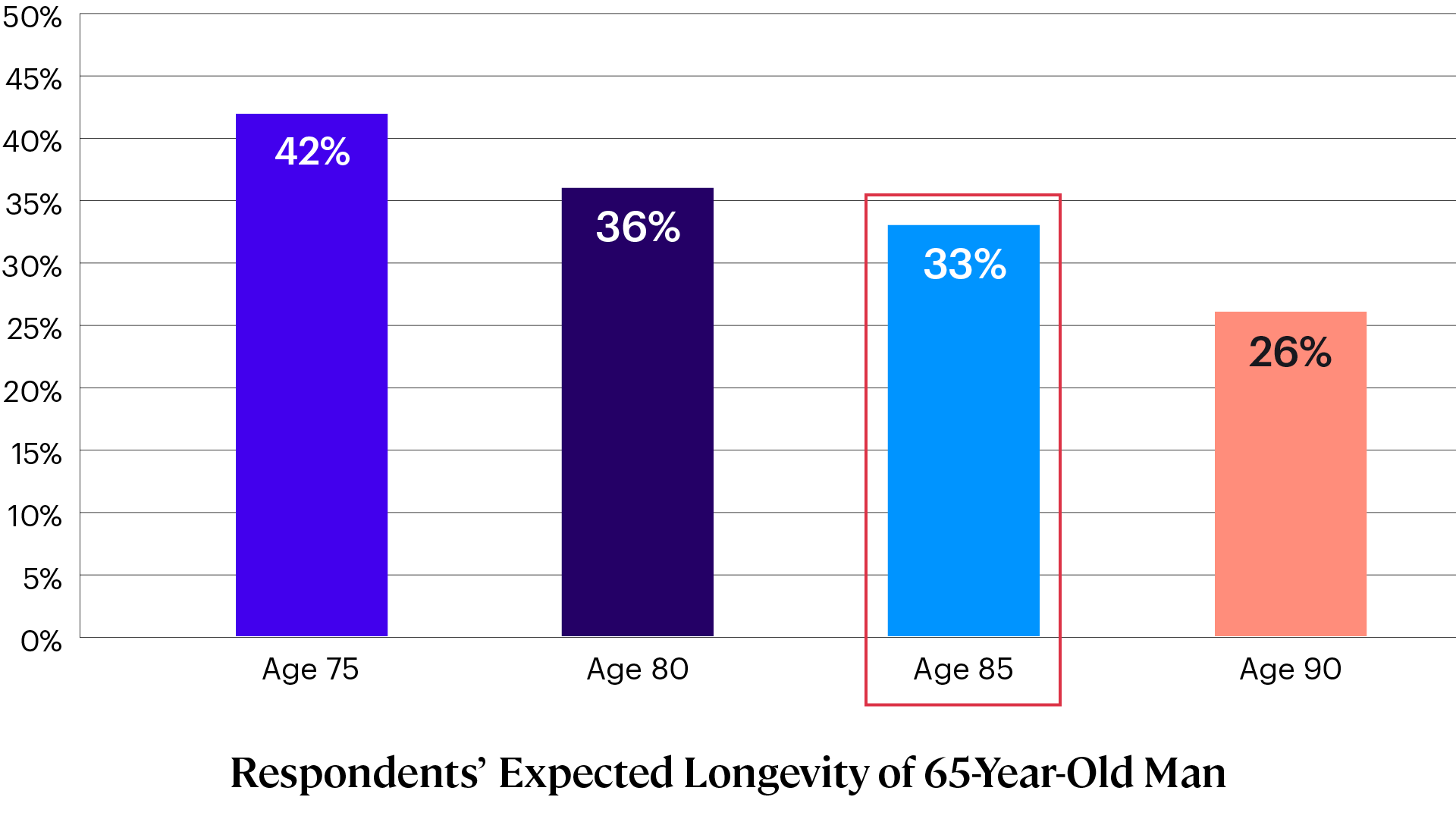

Those who had an unrealistically low expectation of retirement longevity were far more likely to indicate they plan to claim Social Security income benefits before the age of 65. Why is this important? Social Security is the only inflation-adjusted income source most retirees have. Claiming early reduces a retiree’s income for his lifetime and weakens an important source of guaranteed income for workers, many of whom no longer receive employer pensions.

While 42% of those who believed that retirement for a 65-year-old man would only last 10 years expected to claim before age 65, only 33% of those with an accurate estimate of expected longevity planned to claim Social Security early and only 26% of those who overestimated longevity planned to claim before age 65.

Percentage Planning to Claim Social Security Before Age 65 by Longevity Expectations

Figure 2

Respondents* who plan to claim Social Security before age 65 are more likely to underestimate the life expectancy of a 65-year-old man. Those who accurately estimate or overestimate a man’s life expectancy (age 85 or higher) are less likely to plan to take Social Security before age 65.

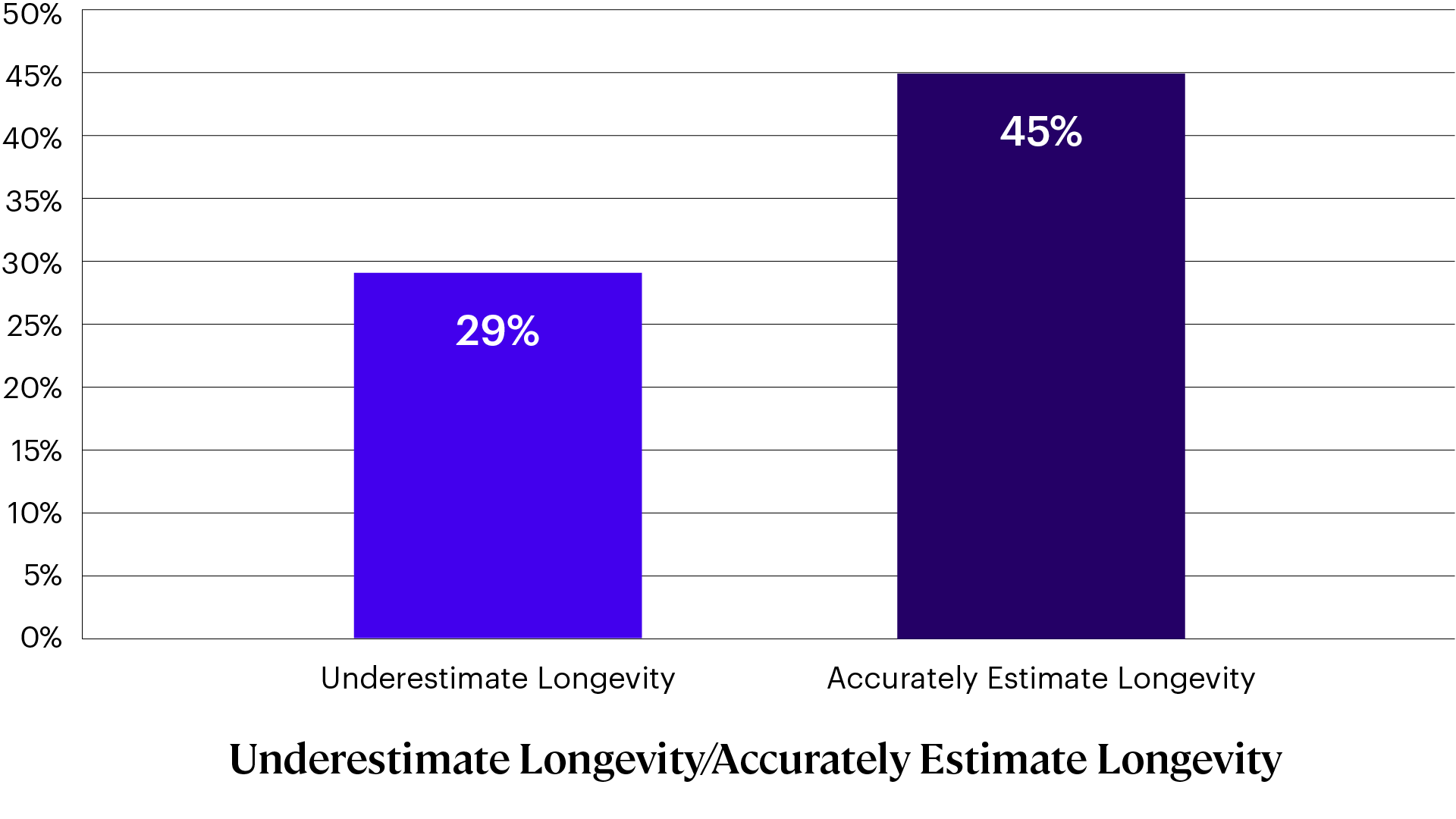

When people are asked “What is the maximum age you would plan for your savings to last in retirement before you run out of money?,” 54% more of those who had an accurate or optimistic idea of expected longevity chose a maximum planning horizon into their 90s compared to those who underestimated longevity.

Percentage Planning for Spending Into Their 90s by Longevity Expectations

Figure 3

Respondents* who plan for their spending to last into their 90s before running out of money are more likely to provide accurate estimates of the life expectancy of a 65-year-old man.

Financial Planning Clients Live Longer

The survey respondents who thought that a 65-year-old man could expect to live 25 years in retirement weren’t wrong for higher-income men. Men and women whose incomes are high enough to work with a financial advisor have made significant gains in retirement longevity in recent decades. Stanford economist Raj Chetty and his co-authors1 found that life expectancy among Americans in the top 5% of income increased 2.34 years for men and 2.91 years for women between 2001 and 2014, compared to just 0.32 years for men and 0.04 years for women in the bottom 5%.

The improvement in longevity among higher-earning Americans is largely due to differences in health-related behaviors. The most notable difference is in rates of smoking, which dropped significantly for higher-income men and women in the United States. Higher-income Americans are also more likely to exercise, eat better diets, and have access to higher-quality healthcare.

Longevity is subject to the laws of statistics. This means that the number of years you’ll spend in retirement looks like a bell curve with a left tail of unlucky retirees and a right tail of those who live into their 90s and beyond. You’re probably going to live longer than your parents. This means that the entire bell curve needs to be pushed a few more years to the right. It also means that today’s healthy retiree will have to fund more years of spending on average, and more than a few will be around into their late 90s and 100s.

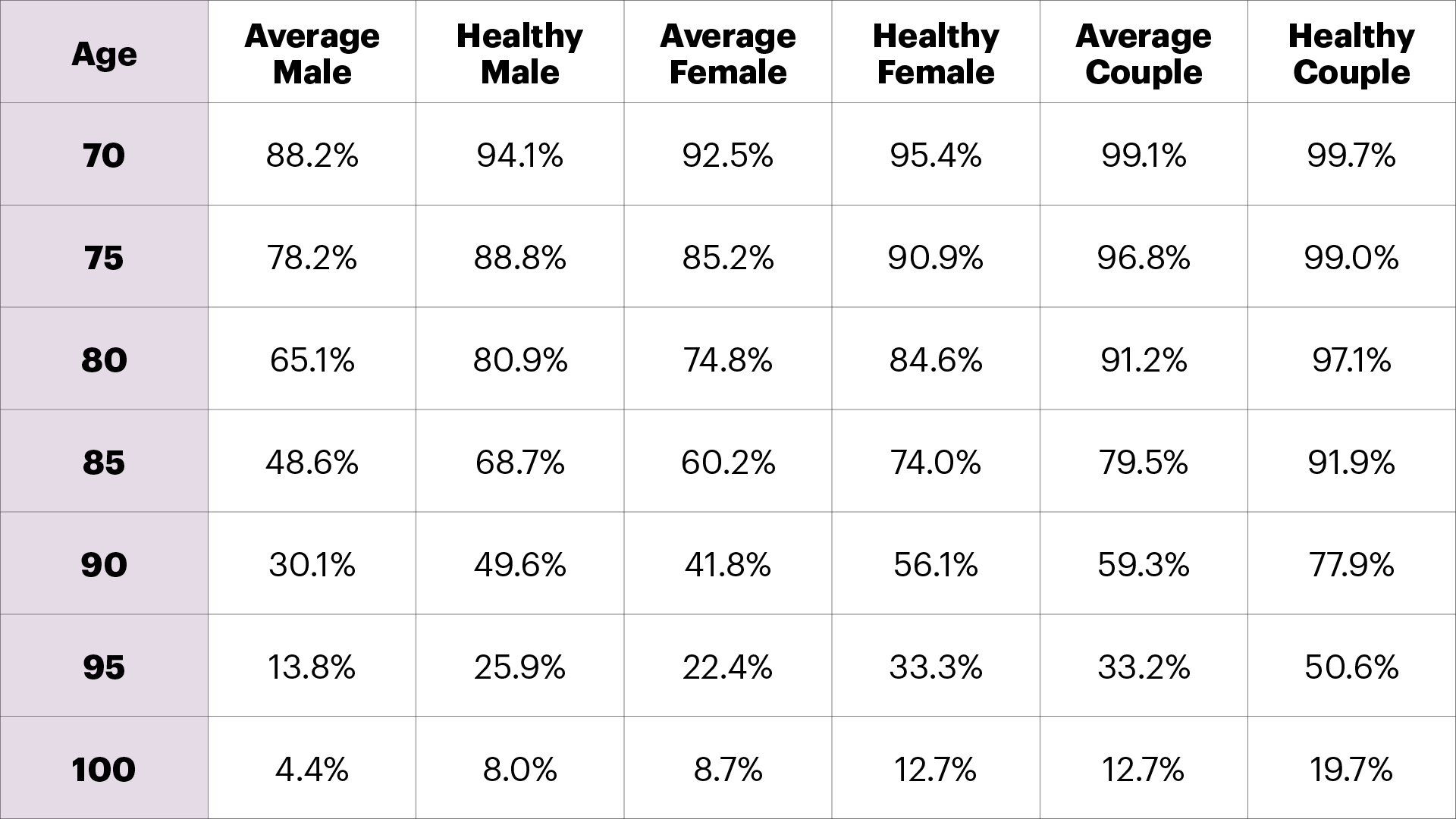

To better understand the difference in the probability of the types of higher-earning individuals (who are more likely to be financial planning clients) being alive at various ages, consider the following table that compares average Americans using the 2017 Social Security Administration mortality table and the 2012 Society of Actuaries annuity mortality table adjusted for expected improvement to the present day. Annuity buyers tend to live longer because they are in the group of higher-income, healthier Americans who have accumulated enough savings to buy a lifetime income.

Probability of Being Alive at Various Ages for 62-Year-Olds

Table 1

Americans who buy annuities tend to live significantly longer than Americans overall. For example, a healthy male is twice as likely (8%) as the average male (4%) to live to age 100.

It’s obvious from Table 1 that healthier, higher-income retirees need to plan for a longer retirement than the average American. A healthy 62-year-old man is 65% more likely to be alive at age 90 than the average American. One-third of healthy 62-year-old women can expect to live to the age of 95, and half of healthy couples will have one spouse who lives longer than 95 years.

The percentages from Table 1 can also be seen as failure rates. If financial advisors create spending plans in which their clients’ money lasts to the age of 90, then half of healthy men, 56% of healthy women, and 78% of healthy couples will outlive their savings.

The traditional failure rate methodology in financial planning considers a withdrawal rate safe if the money lasts to the age of 95. For a healthy couple retiring today, this yardstick can’t be considered safe if half of them will have at least one spouse who lives beyond the age of 95. Even if the money lasts to the age of 100, one in five healthy couples will outlive their savings.

For a healthy couple retiring today, this yardstick [of making money last through age 95] can’t be considered safe if half of them will have at least one spouse who lives beyond the age of 95. Even if the money lasts to the age of 100, one in five healthy couples will outlive their savings.

A Long Life is More Expensive

An easy way to see how much more money a retiree needs to save to fund a longer retirement is to estimate the cost of creating a base of income that lasts to various ages using safe investments. Returns on financial assets are generally variable, but it is possible to buy Treasury bonds that will mature and provide a future income that isn’t subject to investment risk.

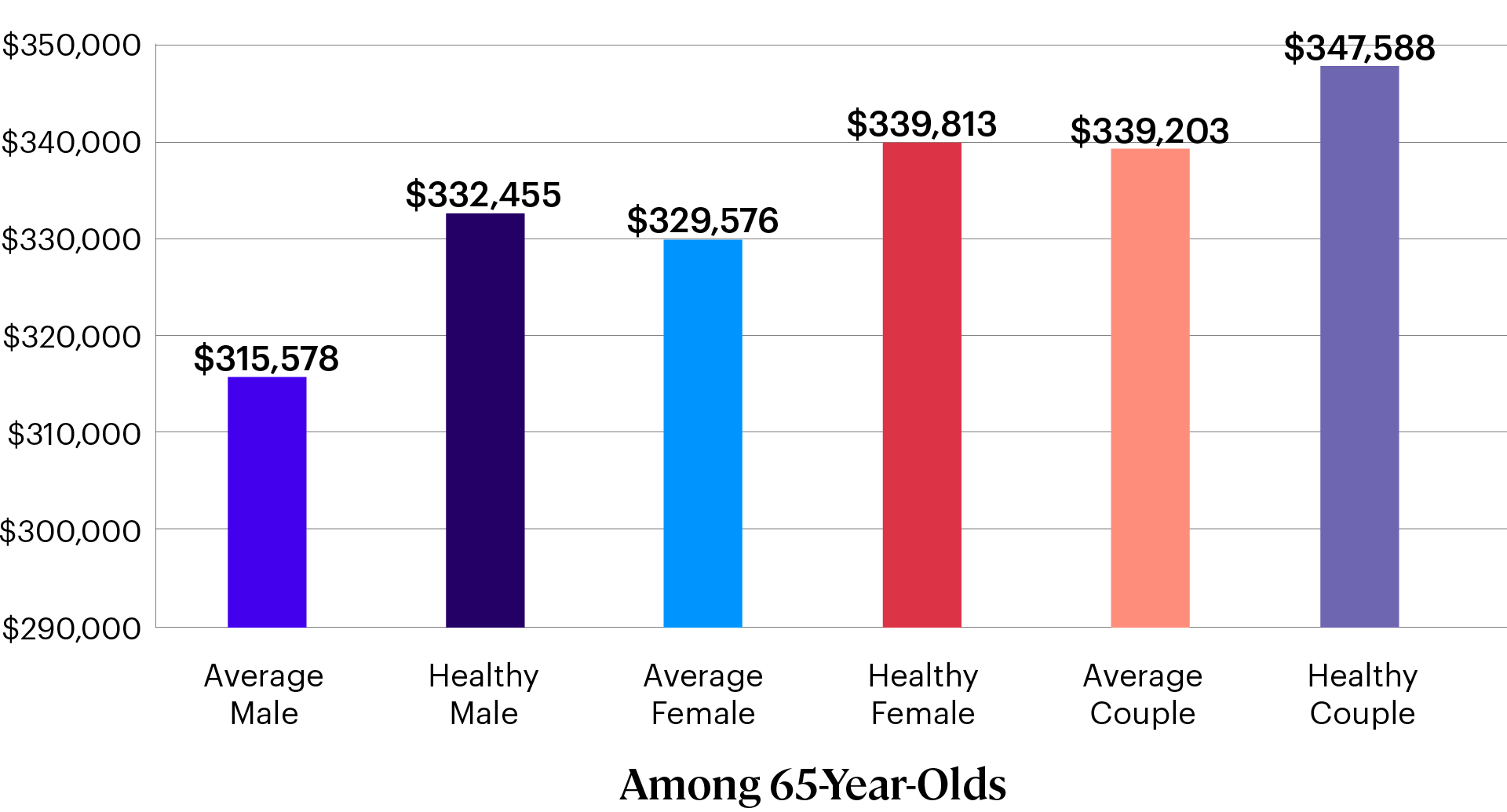

Figure 4 compares the cost of buying a safe income using Treasury bonds to the age at which a healthy man, woman, and couple has a 20% chance of outliving their savings (i.e., 80% probability of success) using yields on April 12, 2024. For example, an average 65-year-old man has a 20% chance of reaching the age of 93 years. The cost of funding $20,000 of income from Treasury bonds at today’s yields will be $315,578. A healthy man has a 20% chance of living to the age of 96 years. It will cost him $332,455 today to buy the same $20,000 of income to an age at which he has a 20% chance of “failure.”

The Cost of Funding $20,000 Treasury Bond Income*

Figure 4

As Figure 4 shows, the cost of income is higher for healthy men, women, and couples who need to plan to fund more years of spending in retirement. This means that healthier and wealthier individuals will have to save more to fund the same lifestyle with an 80% probability of success.

Healthy Americans will have to save more to fund more years of spending in retirement.

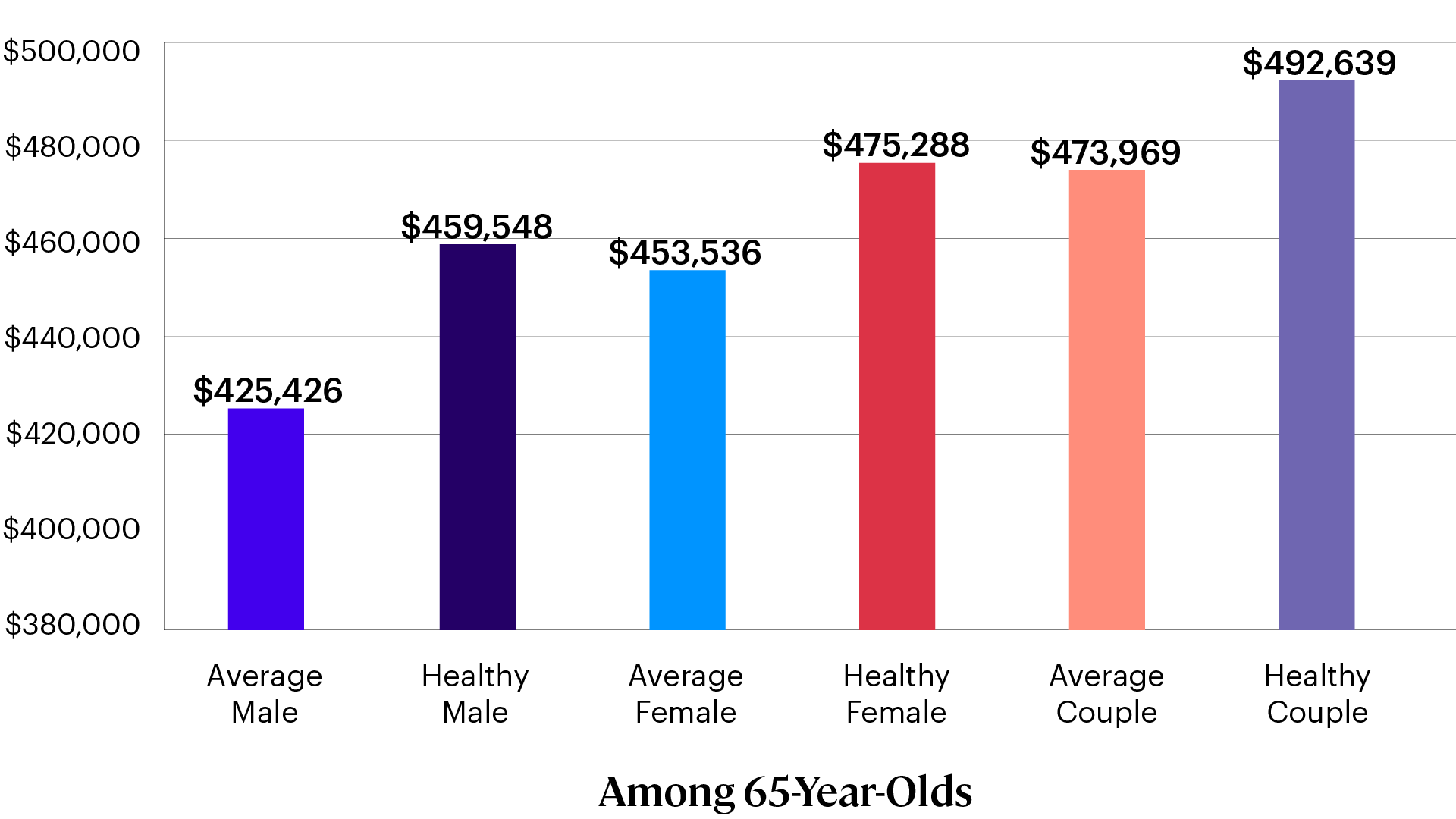

Figure 5 shows the cost of funding $20,000 of inflation-protected income using Treasury Inflation Protected Securities (TIPS). TIPS are more expensive because the amount of income received is expected to rise in the future by the rate of inflation. It would cost a healthy woman $475,288 to buy $20,000 of inflation-protected income with an 80% probability of success, but only $339,813 to buy $20,000 of nominal income each year. Inflation-adjusted income is even more valuable when a retiree can expect to live longer.

The Cost of Funding $20,000 Inflation-Protected Income*

Figure 5

Average male, female, and couple life expectancies based on the 2017 Social Security Administration mortality table. Healthy male, female, and couple life expectancies based on the 2012 Society of Actuaries annuity mortality table. *Cost estimates to achieve an 80% probability of success for a 65-year-old are based on TIPS yields on April 12, 2024.

Although inflation-protected income is more expensive, it can also be more valuable—particularly for healthy Americans who will have to fund longer retirements.

Implications for Planning

Today’s financial planning clients, who are generally healthier and wealthier than the average American, can expect to live significantly longer than their parents, and longer than the average American. Research from the Retirement Income Literacy Study shows that most Americans ages 50 to 75 underestimate the number of years an average retiree will live. Clients of financial advisors are slightly more likely (31%) than unadvised respondents (24%) to correctly answer the longevity literacy question, but 62% either still underestimate or don’t know average longevity.

Advisors can help clients establish a more appropriate planning horizon and make better choices through longevity education. This is especially importance since survey data suggest that individuals who are less longevity-literate are more likely to claim Social Security early and less likely to plan for income into their 90s.

A longer retirement is a more expensive retirement.

Improvements in longevity have several important planning implications:

- A longer retirement is a more expensive retirement. Being longevity literate means recognizing that today’s planning time horizons for healthy clients will extend into their 90s, and for couples even longer. While a longer retirement is good news, funding more years of spending creates a need for creative planning strategies that help retirees get the most out of their saving.

- Research shows that strategies such as tax-efficient distribution planning—in which advisors pay attention to spending down the least tax-efficient assets first and the most tax-efficient assets last, while taking advantage of opportunities to manage tax brackets and using strategic Roth conversions —can extend the life of a portfolio by as much as 20%.

- The higher value of inflation-protected income for healthier clients, and in particular healthier women, means that delayed Social Security claiming is almost always going to provide more retirement wealth than claiming early. Claiming strategies that focus on the expected longevity of a lower-earning spouse can provide an added boost by providing a larger lifetime spousal benefit. For healthy retirees, delayed claiming can reduce the cost of funding a retirement lifestyle by tens or even hundreds of thousands of dollars.

- Finally, retirees can also reduce the cost of funding an income goal by considering the value of transferring the risk of not knowing how long they will need to fund an income goal to an institution. Annuities allow a retiree to spend as if they will live to about an average longevity, freeing up more dollars to spend earlier in retirement and protecting against the risk of living beyond their planning horizon.

The Retirement Income Literacy Study provides actionable insights into older Americans’ financial literacy on 12 retirement topics, including longevity planning.

More From The College:

Get specialized retirement planning knowledge with our RICP® Program.

Related Posts

Reflecting on 25 Years of the Forum on Ethical Leadership

View Details1 The Association Between Income and Life Expectancy in the United States, 2001–2014 - PMC (nih.gov)